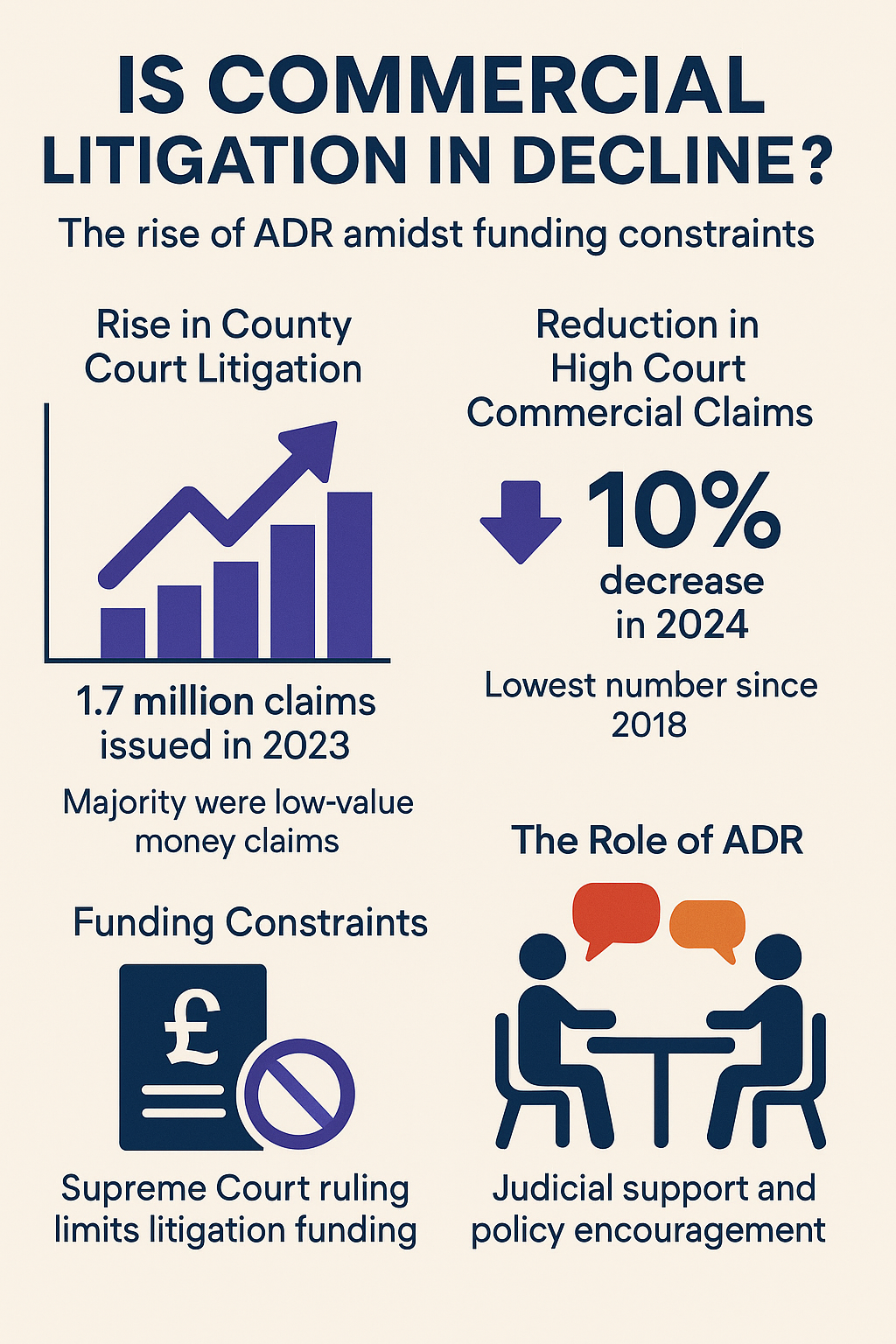

Is Commercial Litigation in Decline? The Rise of ADR Amidst Funding Constraints

In recent years, civil litigation trends in England and Wales have diverged sharply between the County Court and the High Court. While the County Court has seen a consistent increase in claims—particularly low-value money claims—the High Court has experienced a notable reduction in commercial litigation. This shift reflects more than just changes in case volumes; it underscores the growing role of alternative dispute resolution (ADR) and the impact of litigation funding constraints.

Commercial Litigation in Retreat

According to Ministry of Justice figures, over 1.7 million claims were issued in the County Court in 2023, an 11% increase on the previous year. The majority were money claims, with bulk issuers such as lenders and utility companies driving much of the growth. In contrast, the commercial courts of the High Court saw only 3,380 new claims issued in 2024—a 10% decrease and the lowest number since 2018.

This decline in High Court litigation is not a blip, but part of a broader trend. Several factors are at play, chief among them being increased scrutiny and constraints on litigation funding following the Supreme Court’s 2023 ruling in Paccar Inc v Road Haulage Association Ltd. In that landmark case, the Court held that litigation funding agreements entitling funders to a percentage of damages were damages-based agreements, and thus unenforceable unless they complied with strict regulatory requirements. The result? A chilling effect on the willingness of funders to back high-stakes commercial claims.

The Mediation Momentum

In parallel with these funding challenges, ADR—and mediation in particular—has gained significant ground as a viable alternative to courtroom litigation. With increasing judicial encouragement and policy support, mediation is no longer seen as a sign of weakness, but as a cost-effective, strategic choice. The Court of Appeal’s decision in Churchill v Merthyr Tydfil CBC reaffirmed that parties may be compelled to mediate and that unreasonable refusals to do so can result in cost sanctions, even for successful litigants.

For commercial parties, the attractions of mediation are obvious: it offers confidentiality, flexibility, and the opportunity to preserve business relationships while avoiding protracted and costly litigation. Moreover, in a climate of economic uncertainty and funding limitations, resolving disputes outside the courtroom is not just desirable—it may be necessary.

A Structural Shift?

The downturn in High Court commercial claims may signal a structural shift in the legal landscape. As digital transformation in the courts lags behind expectations—three-quarters of court cases are still processed on paper despite a £1.5 billion modernisation project—businesses are increasingly looking elsewhere for swift and efficient justice.

Arbitration continues to attract global commercial disputes, but mediation is becoming the first port of call for many. The Civil Justice Council’s ongoing review of mandatory mediation and reforms to fixed recoverable costs further reinforce the trajectory away from traditional litigation.

Conclusion

Commercial litigation in the High Court may be in decline, but this is not a sign of a weakening justice system. Instead, it reflects the legal profession’s adaptability to financial, procedural, and cultural change. As litigation funding becomes more complex and court processes remain cumbersome, parties are embracing ADR and mediation as smarter, more sustainable ways to resolve their disputes.

The future of dispute resolution may be less about the courtroom and more about the conference room.